How does the Middle East facilitate the pearl and gemstone trade?

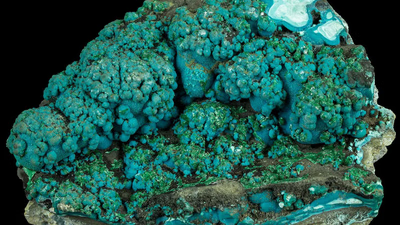

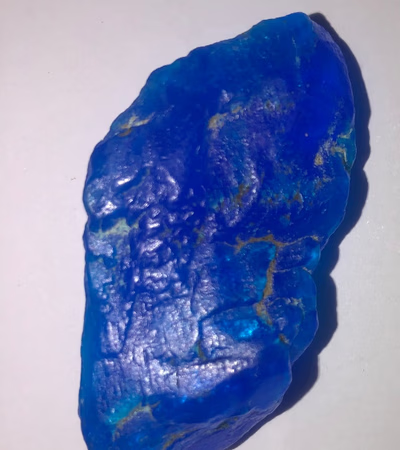

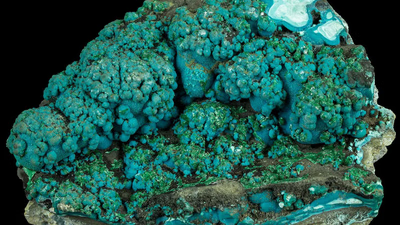

The Middle Eastern pearl market has long been a cornerstone of the region’s rich trade history, especially along the Persian Gulf, renowned for some of the finest natural pearls in the world. Pearls, often referred to as the ‘gems of the sea,’ continue to thrive in the modern commodity trade of West Asia, bolstered by growing demand from neighboring Asian markets. The distinction between natural pearls, cultured pearls, and artificial alternatives plays a critical role in pricing, with natural pearls remaining the most valuable due to their rarity and unique formation process. The Persian Gulf remains a global hub for pearl fishing, a tradition steeped in history but evolving through modern supply chain solutions to meet international standards. The import and export of pearls in the Middle East are facilitated by B2B marketplaces, which connect verified exporters and importers while ensuring transparency and efficiency. These platforms also provide market insights, allowing businesses to navigate fluctuating demand and pricing influenced by factors like quality, size, and origin. The rise of trade advertising platforms and business networking opportunities further supports the visibility and global reach of Middle Eastern pearl traders. The Middle East also plays a significant role in the broader gemstone market, including chrysocolla, turquoise, ruby, emerald, and lapis lazuli.

Chrysocolla, with its vibrant blue-green hues, and turquoise remain particularly sought after in jewelry markets, while gemstones like ruby and emerald cater to high-end luxury buyers. These stones often pass through the same trade and supply chain networks as pearls, leveraging regional strengths in import-export frameworks. Aritral, an AI-driven B2B trade platform, enhances this ecosystem by offering product listings, global sales assistance, AI-powered marketing, and profile management, simplifying transactions for both pearls and gemstones. It empowers Middle Eastern businesses to expand into global markets efficiently while maintaining trust and transparency.

-

Moein 2 months ago

Moein 2 months ago Iran

Gemstones

Iran

Gemstones

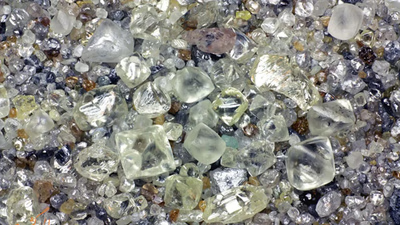

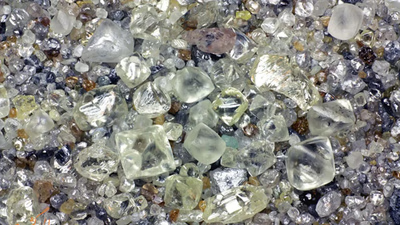

Hello, the stones available are raw and uncut. They are genuine. I have put them up for sale and will negotiate with genuine buyers. Meteorite. Diamon...Details

-

Btm Associates 3 months ago

Btm Associates 3 months ago Pakistan

All kinds of gems stones

Pakistan

All kinds of gems stones

We deal with All kind of Jem stone and precious mineralsDetails

-

Najmeddin 2 months ago

Najmeddin 2 months ago Morocco

Agate dendritique cristal brute

Morocco

Agate dendritique cristal brute

For more information contact us on WhatsApp or GmailDetails

-

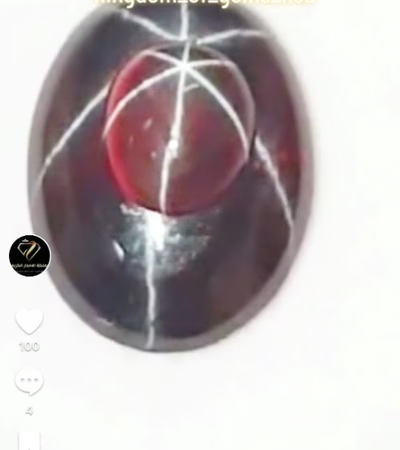

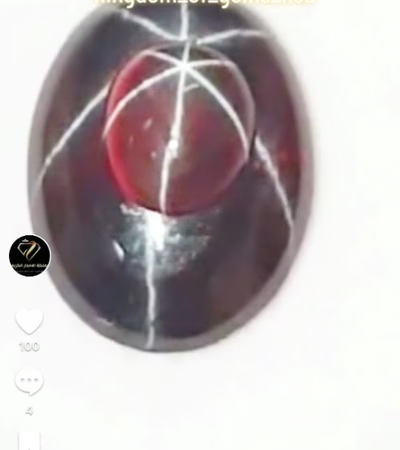

متجر مملكة الأحجار الكريمة 2 months ago

متجر مملكة الأحجار الكريمة 2 months ago Saudi Arabia

Precious and Rare Natural Gemstones

Saudi Arabia

Precious and Rare Natural Gemstones

Untreated natural gemstones, high grades, top qualityDetails

-

Mustafa 2 months ago

Mustafa 2 months ago Morocco

Gemstones

Morocco

Gemstones

GemstonesDetails

-

Salah Abdulkhaleq Abdullah Al-Masabi 2 months ago

Salah Abdulkhaleq Abdullah Al-Masabi 2 months ago Yemen

Gemstones

Yemen

Gemstones

I have types of gemstones and I want to sell them here. I hope someone responds in Yemen or Saudi Arabia. This is my WhatsApp number 0575606621Details

-

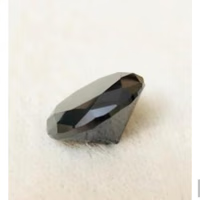

Iran Almas 2 months ago

Iran Almas 2 months ago Iran

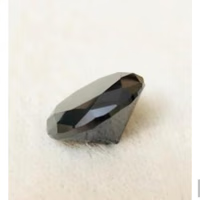

Gemstone, Diamond

Iran

Gemstone, Diamond

A few grams of various diamonds, jade, emeralds, Mars meteorite, moon, etc. , ruby and antidote, remedy stoneDetails

-

Hamed 2 months ago

Hamed 2 months ago Iran

Printing Stone

Iran

Printing Stone

Printing StoneDetails

-

Forushgah Iqbal 4 months ago

Forushgah Iqbal 4 months ago Afghanistan

Buying and Selling Precious Stones and Jewelry

Afghanistan

Buying and Selling Precious Stones and Jewelry

In my store, buying and selling various types of rings with different designs and styles is available.Details

-

Qadur 2 months ago

Qadur 2 months ago Algeria

Meteor

Algeria

Meteor

💌🤍Details

-

Mohammad Asaf 2 months ago

Mohammad Asaf 2 months ago Syria

Precious Stones

Syria

Precious Stones

Precious StonesDetails

-

Mohammad Nasar 2 months ago

Mohammad Nasar 2 months ago Egypt

Precious Stones and Meteorites

Egypt

Precious Stones and Meteorites

Selling rare precious stones and meteorites of all kindsDetails

-

Ahjar 2 months ago

Ahjar 2 months ago Morocco

Precious Stones

Morocco

Precious Stones

Precious stones for those who want to buyDetails

-

Am Mohammad 2 months ago

Am Mohammad 2 months ago Jordan

Pearl

Jordan

Pearl

Natural PearlDetails

-

Abdullah 2 months ago

Abdullah 2 months ago Iraq

Rare Stones like Pearls

Iraq

Rare Stones like Pearls

After greetings and appreciation \nYour brother from Iraq ... has very precious and rare stones \nThe pearl stone is manually extracted from the heart...Details

-

Mehran Moheni 2 months ago

Mehran Moheni 2 months ago Egypt

Precious Stones

Egypt

Precious Stones

Precious stones have more energyDetails

-

Mohammed Ismaeil 2 months ago

Mohammed Ismaeil 2 months ago Saudi Arabia

Precious Stones

Saudi Arabia

Precious Stones

Raw Precious StonesDetails

-

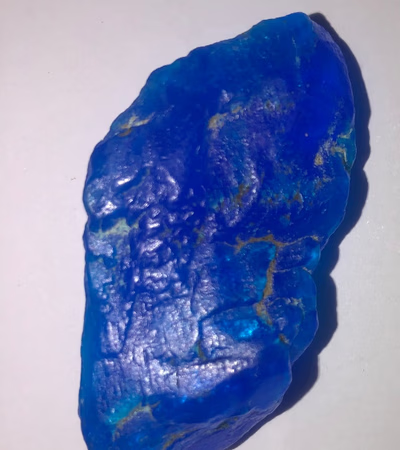

Zaid O Alatow 2 months ago

Zaid O Alatow 2 months ago Saudi Arabia

Stones

Saudi Arabia

Stones

Showing some pictures of precious stonesDetails

-

Ward 2 months ago

Ward 2 months ago Oman

For sale: natural and original pearl, oval-shaped, obtained from a shell on the shores of the Sultanate of Oman.

Oman

For sale: natural and original pearl, oval-shaped, obtained from a shell on the shores of the Sultanate of Oman.

For sale: natural and original pearl, oval-shaped, obtained from a shell on the shores of the Sultanate of Oman. Serious inquiries, please contact the...Details

-

Noor Al-Din Aqra 2 months ago

Noor Al-Din Aqra 2 months ago Turkey

Food

Turkey

Food

Very ExcellentDetails

-

Khaled Al-Halabi 2 months ago

Khaled Al-Halabi 2 months ago Syria

Natural Free Pearl Beads

Syria

Natural Free Pearl Beads

Natural Free Pearl BeadsDetails

-

Bilal 7 months ago

Bilal 7 months ago Jordan

Precious Stones Ruby Diamond Agate Emerald

Jordan

Precious Stones Ruby Diamond Agate Emerald

We have Yemeni agate stones, ruby, emerald, amber, coral.Details

-

Agate Trade in West Asia: Market Insights and Export Trends

Agate, a semi-precious gemstone renowned for its vibrant colors and unique patterns, holds a central position in the West Asian and Middle Eastern trade dynamics. The region, particularly countries like Iran, boasts significant agate reserves, making it a hub for global exports of agate, opal, and onyx gemstones. Known for its durability and aesthetic appeal, agate is highly sought after in jewelry and decorative industries worldwide. The Asian agate market is witnessing growth, fueled by increasing demand from both local and international buyers. Middle Eastern trade platforms play a pivotal role in connecting global markets to verified exporters and importers, offering transparency and efficiency. These platforms provide essential services such as product listings, market insights, and trade advertising, ensuring seamless transactions across borders. The trade of agate, alongside other gemstones like turquoise, ruby, and lapis lazuli, has become highly profitable due to the region’s rich geological resources and strategic location. Iran, in particular, stands out for its vast agate reserves, contributing significantly to the gemstone trade in West Asia.

The export potential of agate and similar gemstones is bolstered by regional B2B marketplaces, fostering business networking opportunities and supply chain solutions. Verified exporters leverage these platforms to showcase region-specific product listings, enhancing trust and global reach. Additionally, gemstones like chrysocolla and turquoise add to the region’s allure, with their unique colors and cultural significance. The Middle East facilitates robust trade networks for these stones, bridging Asian and global markets. As the demand for gemstones like agate continues to rise, platforms like Aritral offer AI-driven solutions to streamline international trade, enabling businesses to capitalize on this growing market efficiently.

-

Amber Trade in Middle East: The Gold of the Sea in West Asia Markets

Amber, often referred to as the "Gold of the Sea," holds a unique position in the Middle Eastern and West Asian trade markets. Its organic origins and rich hues, ranging from honey to deep orange, make it a prized gemstone in the global jewelry industry. Middle Eastern trade platforms, particularly B2B marketplaces, play a pivotal role in connecting verified exporters and importers for amber and other gemstones such as turquoise, chrysocolla, and ruby. Oriental Amber Traders in Asia leverage these platforms to facilitate seamless transactions and access regional product listings, ensuring transparency and trust. Amber"s significance extends beyond aesthetics. In various cultures, it is believed to have therapeutic properties, which adds to its market value. The Middle East, as a central hub for commodity trade, has seen a surge in demand for amber and its derivatives. Regional platforms provide market insights, helping businesses navigate pricing trends and demand fluctuations effectively.

Amber is not the only gemstone thriving under this dynamic. Chrysocolla, with its striking blue-green colors, is gaining traction in the jewelry industry, while turquoise and lapis lazuli continue to be celebrated for their ancient ties to Middle Eastern heritage. From emeralds associated with wealth to diamonds symbolizing prestige, these gemstones are traded extensively through West Asian supply chains. This is bolstered by verified B2B platforms that enhance transparency and facilitate global networking. Aritral, an AI-driven B2B platform, supports this ecosystem by offering tools like AI-powered marketing and global sales assistance. These features empower traders to manage profiles, advertise products, and connect with verified buyers and sellers. With the Middle East"s strategic location and robust trade networks, gemstones like amber are poised for sustained growth, reinforcing the region"s status as a global trade hub. "

-

Charoite"s Role in Middle Eastern Gemstone Trade"

Charoite, a rare and striking violet gemstone, is gaining momentum in the Middle Eastern and West Asian markets as a valuable commodity for luck, wealth, and metaphysical benefits. The region"s dynamic B2B trade platforms have enabled seamless connections between verified exporters and importers, driving growth in the gemstone industry. The Middle East, a hub for global gemstone trade, facilitates the buying and selling of Charoite through advanced supply chain solutions and regional product listings. These platforms provide market insights, allowing businesses to navigate pricing trends and expand their networks effectively. Charoite is especially sought after in West Asia, where its unique aesthetic and metaphysical properties—linked to luck, wealth, and harmony—make it a preferred choice for jewelry and spiritual purposes. Verified exporters in the region ensure authenticity, supporting the gemstone"s premium market positioning. Importers leverage Middle Eastern trade advertising platforms to source high-quality Charoite, contributing to its rising demand. The Middle Eastern gemstone market also thrives on synergies with other valuable stones like Chrysocolla, Turquoise, Ruby, and Tanzanite.

These gemstones, known for their distinct colors and cultural significance, complement Charoite in trade dynamics. As regional platforms evolve with AI-driven marketing tools, exporters and importers find it easier to scale their operations, diversify their portfolios, and enhance transparency in trade. Aritral, for instance, empowers businesses by streamlining international transactions and facilitating direct communication across borders. In conclusion, Charoite"s growing prominence in the Middle East and West Asia underscores the significance of regional trade platforms in connecting global markets. This gemstone"s role in fostering wealth and luck not only bolsters its demand but also cements its place as a cornerstone in the thriving gemstone industry of the region.

-

Chrysocolla: A Gemstone in Middle Eastern Trade Dynamics

Chrysocolla, a captivating gemstone admired for its vibrant green and blue hues, has emerged as a valuable commodity in the Middle East and West Asia"s gemstone trade. Known for its resemblance to turquoise, this unique mineral is in high demand among collectors, jewelers, and industrial buyers across these regions. Chrysocolla"s appeal lies in its aesthetic properties and its versatility, making it a sought-after material for jewelry, carvings, and ornamental uses. The Middle East and West Asia are pivotal hubs for the global gemstone trade, facilitating connections between verified exporters and importers through B2B marketplaces. Regional platforms are enhancing transparency and efficiency in commodity trading by offering supply chain solutions and accurate market insights. Chrysocolla has carved a niche within this ecosystem, benefiting from the established networks used to trade gemstones like turquoise, ruby, emerald, and lapis lazuli. The role of trade advertising platforms in showcasing Chrysocolla’s unique attributes has further boosted its visibility and sales. Chrysocolla’s similarity to turquoise adds intrigue to its market dynamics.

In regions like West Asia, where turquoise gemstones have historic significance, Chrysocolla has attracted buyers looking for affordable yet equally impressive alternatives. These dynamics are reflected in regional product listings and marketplace trends, where Chrysocolla is gaining attention alongside other gemstones such as jade, ruby, and amber. Aritral, an AI-driven B2B platform simplifying international trade, is contributing to this transformation by offering services like global sales assistance, AI-powered marketing, and verified exporter profiles. Its supply chain solutions are particularly valuable for commodities like Chrysocolla, ensuring seamless transactions in the competitive Middle Eastern gemstone market. As Chrysocolla continues to shine in the gemstone industry, its trade reflects the broader integration of Middle Eastern markets with global supply chains, creating lucrative opportunities for businesses across Asia and beyond.

-

Middle Eastern Diamond Trade: Insights and Future Trends

The Middle East and West Asia are increasingly pivotal in the global diamond trade, leveraging their strategic position as crossroads between East and West. While the region is not a top diamond producer, it ranks sixth globally, with notable resources distributed across specific areas. For instance, some Middle Eastern territories are seeing growing interest in diamond mining, bolstered by advancements in exploration techniques and market demand. However, the Middle East’s commercial advantage lies in its role as a trading hub rather than a primary producer. Verified exporters and importers rely on regional B2B marketplaces to facilitate secure and efficient trade. The diamond trade in the Middle East benefits from a well-integrated supply chain and dynamic market insights. These platforms enable businesses to list regional products, advertise trade opportunities, and connect with stakeholders across Asia and beyond. Diamonds, along with other gemstones like turquoise, ruby, and emerald, are traded extensively, especially in jewelry and luxury sectors.

As a complement to diamonds, other minerals like lapis lazuli, jade, and amber (nicknamed ‘Gold of the Sea’) further diversify the Middle Eastern gemstone economy. Historically, diamonds have represented wealth, and their demand continues to rise globally, with Asia emerging as a significant consumer base. Middle Eastern trade platforms simplify this process by providing AI-powered marketing solutions, product listing management, and verified user networks. For instance, platforms like Aritral enable businesses to navigate the intricate import-export landscape with ease. This digital shift is increasingly critical as the diamond trade moves into the future, driven by consumer preferences for transparency and ethical sourcing. With innovations in trade technology and a strategic geographic location, the Middle East remains a cornerstone of the global diamond and gemstone economy.

-

Emerald and Middle Eastern Gemstone Trade Insights

Emerald, regarded as the second most precious gemstone after diamond, holds a pivotal role in the Middle East and West Asian gem trade. Renowned for its vivid green hue, this precious stone is a symbol of wealth and prosperity, and its trade contributes significantly to regional economies. The Middle East serves as a central hub for the import and export of emeralds, leveraging its strategic location to connect Asian and global markets. Verified exporters and importers on platforms like Aritral have facilitated a more secure and transparent trading environment, establishing trust among buyers and sellers. Emerald’s value lies not only in its rarity but also in its perception as a stone that can increase the flow of wealth and good fortune. Distinguishing natural emeralds from synthetic ones requires expertise, as genuine stones exhibit slight inclusions and a distinct color vibrancy. Key emerald reserves and mines are located in Colombia, Zambia, and Brazil, with significant demand coming from Middle Eastern jewelry markets. In addition to emeralds, the region’s gemstone trade encompasses spinel, turquoise, ruby, and lapis lazuli.

Spinel, known for its durability and diversity in color, is gaining traction in West Asia due to its affordability and aesthetic appeal. Similarly, the Middle Eastern pearl and turquoise markets thrive, with pearls symbolizing elegance and turquoise reflecting cultural heritage. B2B marketplaces like Aritral are streamlining the gemstone trade by offering advanced supply chain solutions, regional product listings, and market insights. This infrastructure supports the efficient trading of gemstones, fossils, and meteorites, helping businesses navigate pricing dynamics and market trends. The Middle East’s role as a gemstone trade hub underscores its importance in connecting Asia with international markets, driving economic growth in the region.

-

Jade Stone Trade in West Asia: Insights and Market Trends

Jade, often referred to as the "Stone of Paradise," plays a significant role in the gemstone trade of West Asia and the Middle East. The Middle Eastern jade market is a hub for verified exporters and importers, connecting global buyers with regional suppliers through dynamic B2B platforms. Known for its transcendental properties and rich cultural significance, jade finds demand in jewelry, décor, and spiritual uses. Pricing for jade is influenced by its color, clarity, origin, and craftsmanship, with premium-grade jade sourced from renowned mines in Asia commanding the highest value. The Middle East serves as a critical link between Asia and international markets, facilitating the trade of not only jade but also other gemstones like turquoise, ruby, and lapis lazuli. Platforms specializing in gemstones offer detailed product listings, market insights, and supply chain solutions, ensuring transparency and efficiency. Jade"s appeal lies in its vibrant green hues and symbolic value, making it a sought-after commodity for both collectors and commercial buyers. In addition to jade, the region also excels in the trade of other rare minerals such as chrysocolla, spinel, and amber.

Verified exporters leverage advanced trade advertising platforms to promote these products, while importers benefit from access to authenticated sources. The Middle Eastern jade market, supported by robust supply chain networks, continues to thrive as a vital component of its broader gemstone trade ecosystem. Aritral, an AI-driven B2B platform, simplifies these transactions by providing product listing services, direct communication tools, and AI-powered marketing solutions to enhance global sales. By fostering trust and efficiency, platforms like Aritral enable seamless trading experiences for jade and other gemstones in the Middle East and beyond. "

-

Lapis Lazuli Trade in West Asia and Middle Eastern Gemstone Markets

Lapis lazuli, a mesmerizing azure gemstone, has been a cornerstone of trade and culture in West Asia for centuries. Known for its deep blue color and spiritual properties, it holds a prominent place in the global gemstone market, particularly in the Middle East and Asia. This region serves as a critical trade platform, leveraging historical trade routes and modern B2B marketplaces to connect verified exporters and importers for gemstones like lapis lazuli, ruby, emerald, and turquoise. The Middle East, as a hub for commodity trade, facilitates the import and export of lapis lazuli through well-structured supply chain solutions and regional product listings. This enables businesses to tap into market insights and enhance their reach across West Asia and beyond. Lapis lazuli mines, primarily located in Afghanistan, are central to its trade, with the stone being used in jewelry, decor, and chakra therapy. Differentiating genuine lapis lazuli from synthetic variations remains a key challenge, but modern techniques and trade standards help ensure authenticity. Emerald, one of the most precious stones after diamonds, also plays a significant role in regional trade, driving economic value and financial flow.

Similarly, gemstones like spinel, turquoise, and amber underline the diverse market dynamics in the Middle East. Spinel, with its vibrant hues, is particularly popular in jewelry, while turquoise, often linked to ancient Middle Eastern cultures, continues to thrive in contemporary trade. Other stones like tanzanite, jade, and charoite further diversify the market, attracting international buyers. Platforms like Aritral simplify these global trade dynamics by offering AI-powered marketing, product listings, and verified sourcing solutions. Such platforms ensure that businesses remain competitive in the gemstone trade while navigating the complexities of the Middle Eastern and Asian markets.

-

Middle East Meteorite and Gemstone Trade Insights

The Middle East has established itself as a dynamic hub for the trade of rare commodities, gemstones, and meteorites, connecting West Asia with global markets. Meteorites, in particular, are gaining traction as a niche but valuable asset, with growing interest among collectors and scientific communities. The Middle Eastern meteorite market benefits from its strategic position, facilitating the import and export of these celestial objects across Asia. Platforms that ensure the verification of sellers and buyers have contributed to the credibility and growth of this specialized market. Gemstones like chrysocolla, turquoise, and lapis lazuli also play a pivotal role in the region’s trade ecosystem. Chrysocolla, with its unique hues, has become increasingly popular in the Middle East, driving demand in B2B marketplaces and fostering connections between verified exporters and importers. Similarly, the region"s turquoise trade thrives, offering competitive pricing and robust supply chain solutions. Middle Eastern platforms are instrumental in connecting these gemstones to global markets, including emeralds, rubies, and pearls, which are staples in the jewelry industry.

Amber, known as the "Gold of the Sea," and fossils also form part of the broader commodity trade in West Asia. With increasing demand for these materials, Middle Eastern trade platforms provide insights into pricing, market trends, and export opportunities. The region’s expertise in supply chain management ensures seamless trade flows, even for rare materials like charoite and spinel. Aritral, an AI-driven B2B platform for commodities and raw materials, simplifies international trade by offering verified product listings, global sales assistance, and AI-driven marketing. Its tools can empower businesses to participate effectively in the Middle Eastern gemstone and meteorite markets, fostering transparency and growth. "

-

Middle Eastern Pearl and Gemstone Trade Insights

The Middle Eastern pearl market has long been a cornerstone of the region’s rich trade history, especially along the Persian Gulf, renowned for some of the finest natural pearls in the world. Pearls, often referred to as the ‘gems of the sea,’ continue to thrive in the modern commodity trade of West Asia, bolstered by growing demand from neighboring Asian markets. The distinction between natural pearls, cultured pearls, and artificial alternatives plays a critical role in pricing, with natural pearls remaining the most valuable due to their rarity and unique formation process. The Persian Gulf remains a global hub for pearl fishing, a tradition steeped in history but evolving through modern supply chain solutions to meet international standards. The import and export of pearls in the Middle East are facilitated by B2B marketplaces, which connect verified exporters and importers while ensuring transparency and efficiency. These platforms also provide market insights, allowing businesses to navigate fluctuating demand and pricing influenced by factors like quality, size, and origin. The rise of trade advertising platforms and business networking opportunities further supports the visibility and global reach of Middle Eastern pearl traders. The Middle East also plays a significant role in the broader gemstone market, including chrysocolla, turquoise, ruby, emerald, and lapis lazuli.

Chrysocolla, with its vibrant blue-green hues, and turquoise remain particularly sought after in jewelry markets, while gemstones like ruby and emerald cater to high-end luxury buyers. These stones often pass through the same trade and supply chain networks as pearls, leveraging regional strengths in import-export frameworks. Aritral, an AI-driven B2B trade platform, enhances this ecosystem by offering product listings, global sales assistance, AI-powered marketing, and profile management, simplifying transactions for both pearls and gemstones. It empowers Middle Eastern businesses to expand into global markets efficiently while maintaining trust and transparency.

-

Ruby and Gemstone Trade in the Middle East: Insights and Dynamics

The gemstone trade in West Asia and the Middle East has long been a cornerstone of regional commerce, connecting markets across Asia through a dynamic B2B ecosystem. Ruby, with its deep red hues and exceptional brilliance, holds a special place in this market. Known for its beauty and versatility, ruby gemstones are a favorite in the jewelry industry, contributing significantly to the Asian Ruby Crystal Market and the Natural Ruby Stone value in the Middle East. The pricing of rubies is influenced by their origin, clarity, and size, with Burmese rubies often commanding the highest premiums. Verified exporters and importers facilitate a seamless supply chain for rubies and other gemstones, ensuring quality and authenticity in trade. Beyond ruby, other prized gemstones such as lapis lazuli, emerald, spinel, turquoise, and pearl dominate the trade landscape. Lapis lazuli, for instance, is highly sought after for its azure tones and historical significance, with trade flourishing through Middle Eastern and West Asian markets. Emerald, often considered second only to diamonds in value, boosts economic activity in the region due to its luxurious appeal and increasing demand in jewelry design.

Spinel, with its wide range of colors, and turquoise, valued for its ancient cultural symbolism, also play pivotal roles in regional trade. The Middle East serves as a hub for the import and export of gemstones, pearls, fossils, and meteorites, leveraging platforms like Aritral to provide market insights, verified business networking, and trade advertising solutions. This robust infrastructure supports not only gemstones but also commodities like amber, jade, charoite, and tanzanite, which see steady demand in global markets. By fostering regional product listings and facilitating direct communication, the Middle East continues to promote growth in the gemstone and broader commodities trade, making it a vital link in Asia"s supply chain solutions. "

-

Exploring the Market Insights of Spinel in the Middle East

Spinel, a versatile and precious gemstone, holds a pivotal place in West Asia and the Middle Eastern trade markets. Renowned for its vibrant hues ranging from deep red to cobalt blue, Spinel has historically been mistaken for rubies, adding to its intrigue in the global gemstone trade. The Middle East, with its well-established role as a trade hub, facilitates the import and export of Spinel through B2B marketplaces, verified exporters, and transparent supply chain solutions. Platforms like Aritral enable regional product listings and provide market insights, ensuring efficiency and security in transactions. The market of Spinel in the Middle East is thriving due to its growing demand in luxury jewelry and its symbolic significance in various cultures. Spinel"s competitive pricing compared to ruby and emerald makes it an attractive alternative for buyers. For instance, red Spinels, often sourced from mines in Myanmar and Sri Lanka, are highly prized for their rich colors and durability. Methods to differentiate Spinel from ruby include advanced gemological tools, as Spinel typically exhibits unique optical properties like a single refractive index.

West Asia also contributes significantly to Spinel"s trade dynamics, leveraging its proximity to major mines and its strategic position in global trade routes. Pricing strategies for Spinel vary based on factors such as origin, clarity, and size. Artificial Spinels are detectable through fluorescence, inclusions, and refractive testing. The demand for other gemstones such as turquoise, pearl, ruby, and lapis lazuli complements Spinel"s market growth, supported by the Middle East"s expertise in gemstone trade networks. Aritral, an AI-driven B2B platform, streamlines Spinel transactions by offering direct communication tools, AI-powered marketing, and global sales assistance. These services enhance transparency and build trust among international buyers and sellers, cementing the Middle East"s position as a cornerstone in the gemstone trade industry. "

-

Tanzanite Trade in West Asia: Dynamics and Insights

Tanzanite, a rare and captivating gemstone, has gained prominence in the West Asian and Middle Eastern commodity trade, particularly through B2B platforms and regional trading hubs. Known for its vivid hues—ranging from deep blue to violet—this gemstone is primarily sourced from Tanzania, making it a highly sought-after item in global markets. The Middle East plays a pivotal role in connecting Tanzanite traders with buyers across Asia, leveraging verified exporters, supply chain solutions, and market insights for seamless transactions. The Tanzanite stone buying and selling market in West Asia thrives on its exclusivity and aesthetic appeal, attracting significant interest from the jewelry sector. Its value varies depending on color, clarity, and carat weight, with West Asian traders offering competitive pricing through transparent marketplaces. Middle Eastern trade platforms further enhance this by providing regional product listings and fostering business networking opportunities. Alongside Tanzanite, other gemstones like Chrysocolla, Turquoise, Ruby, and Emerald also form a significant part of the Middle Eastern gemstone trade. These platforms integrate verified exporters and importers to ensure authenticity and quality, a vital factor for high-value commodities like Tanzanite and Diamond.

The region"s role as a trade advertising hub promotes market efficiency and connectivity, benefiting traders and buyers alike. Aritral, an AI-driven B2B marketplace, aids in this ecosystem by offering services such as product listing, direct communication, and AI-powered marketing, enabling smooth international trade in gemstones and other commodities. By providing access to real-time market insights, Aritral empowers traders to make informed decisions, driving the growth of Tanzanite and other gemstones in the Middle East and West Asia. "

-

West Asia Gemstone Trade: Topaz and Beyond

The gemstone trade in the Middle East and West Asia is experiencing a dynamic transformation, driven by robust platforms connecting verified exporters and importers. Topaz, often celebrated for its brilliant and diverse colors, stands as a key player in this market. With reserves spread across the globe, the Asian Topaz Market is particularly significant, bolstered by West Asia"s strategic role in import-export operations. This region facilitates efficient supply chain solutions and transparent business networking, ensuring the seamless movement of topaz and other gemstones like ruby, emerald, and lapis lazuli. Middle Eastern trade platforms are pivotal in fostering growth for gemstones such as chrysocolla, turquoise, pearl, and amber. Chrysocolla, admired for its unique colors, finds its niche in connecting verified exporters from Asia to global buyers. Similarly, turquoise enjoys historical significance in the region, with West Asia acting as a hub for trade and processing. Pearls, often dubbed the treasures of the sea, maintain their allure in the jewelry industry, supported by sophisticated supply chain mechanisms.

Amber, commonly referred to as the ‘Gold of the Sea,’ plays a vital role in West Asia"s gemstone market. Meanwhile, diamonds, emeralds, and spinels drive high-value transactions, leveraging Middle Eastern market insights and advertising platforms. Agate and lapis lazuli, with their distinctive appearances and uses, further enrich the gemstone trade. Additionally, niche markets such as charoite, meteorites, fossils, and tanzanite cater to specialized buyers and sellers. Aritral, an AI-driven B2B platform, simplifies these transactions, offering product listings, direct communication, and AI-powered marketing. By enhancing market transparency and efficiency, it ensures the Middle East remains a cornerstone of the global gemstone trade.

-

Turquoise and Gemstone Trade in the Middle East

Turquoise, a captivating gemstone known for its vibrant blue-green hues, has been a significant part of Middle Eastern trade for centuries. Historically, Persian turquoise—renowned for its intense color and minimal veining—has been a cornerstone of the region"s gemstone economy. Today, the Middle East remains a vital hub for turquoise and other gemstones like ruby, emerald, and lapis lazuli, serving as a bridge between Asian suppliers and global buyers. The West Asian turquoise market thrives on verified exporters and importers, leveraging B2B platforms to facilitate regional product listings and ensure secure transactions. Turquoise"s value and price vary based on factors like origin, color, matrix patterns, and carat weight. Persian turquoise, in particular, commands premium pricing due to its historical significance and quality. Beyond turquoise, the Middle Eastern gemstone trade includes high-demand stones like ruby, prized for its vivid red hue and role in the jewelry industry, and emeralds, which are second only to diamonds in perceived value. Lapis lazuli, with its deep azure tones, is another significant trade item, often sourced from West Asia to meet global demand for ornamental and jewelry uses.

Spinel, chrysocolla, pearls, and agate also contribute to the region’s gemstone trade, with each stone offering unique attributes and market dynamics. Supply chain solutions play a crucial role in ensuring the efficient import and export of these gemstones. Platforms like Aritral simplify this process by providing AI-powered marketing, product listings, and direct communication tools, enhancing market insights and networking opportunities for businesses in the region. In conclusion, the Middle East"s gemstone market is a dynamic ecosystem, integrating ancient traditions with modern trade practices. Turquoise, alongside other precious stones, continues to captivate global markets, underscoring the region"s pivotal role in international trade.

-

Gemstone and Fossil Trade in the Middle East and West Asia

The Middle East and West Asia are emerging as pivotal regions in the global gemstone and fossil trade, leveraging advanced B2B platforms to connect verified exporters and importers. Among the gemstones, Chrysocolla stands out for its vibrant, unique colors, enriching the jewelry industry and solidifying its importance in Middle Eastern trade hubs. The region also facilitates the trade of turquoise, pearls, rubies, and diamonds, with turquoise playing a significant historical and economic role due to its cultural significance in ancient Middle Eastern civilizations. Verified exporters utilize regional B2B marketplaces to trade gemstones like emeralds, tanzanites, lapis lazuli, and spinels. Emeralds, in particular, are valued not only for their beauty but also for their perceived ability to enhance financial prosperity. Precious stones such as topaz, charoite, jade, and agate contribute to the flourishing gemstone markets, supported by supply chain solutions and market insights tailored for West Asia. The fossil stone trade in the Middle East is gaining momentum, with a focus on diverse fossils, including meteorites and amber, often referred to as the "Gold of the Sea. " Fossils found in specific regions across West Asia are priced based on rarity, geological origin, and historical significance.

International buyers and sellers can leverage platforms for transparent communication, comprehensive product listings, and pricing guidance, ensuring smooth transactions. Aritral, an AI-driven B2B platform, simplifies these trade processes by offering tools like direct communication, global sales assistance, AI-powered marketing, and profile management for exporters. By fostering seamless connections, platforms like Aritral empower businesses to expand their reach in Middle Eastern and global markets for commodities such as gemstones and fossils.

-

Natural pearl fishing in the Persian Gulf

Natural pearl fishing in the Persian Gulf has a storied history, particularly around Bahrain, known for its rich oyster beds. Skilled divers employed traditional techniques to harvest oysters, facing dangers like drowning and shark attacks. This labor-intensive process involved extracting and grading pearls for local markets and international trade, significantly contributing to the region"s economy and cultural heritage. However, the rise of cultured pearls in the early 20th century, coupled with overfishing and environmental changes, led to a decline in natural pearl demand. Historically significant areas for pearl diving included "Mughas" or "Mughas al-Lulu

-

Types of pearls

Pearls are categorized based on their cultivation methods, environments, and the mollusks that produce them. The two main types are natural and cultured pearls, with further distinctions between saltwater and freshwater varieties. Saltwater pearls, such as Akoya and South Sea pearls, are known for their high luster and larger sizes, while freshwater pearls are more abundant and come in various colors but typically have a lower shine. Akoya pearls, primarily from Japan and China, range from 2 to 10 millimeters in size and are often white or cream-colored. South Sea pearls, sourced from Australia and the Philippines, can be as large as 20 millimeters and exhibit luxurious luster in shades of white or gold. Mabe pearls have a unique shape due to their cultivation method involving a half-spherical nucleus. Conch pearls are rare gems known for their vibrant colors found in queen conch mollusks. Environmental factors like water quality and temperature significantly influence pearl characteristics, leading to variations in size, shape, and color among different types.

Tahitian pearls stand out for their dark hues cultivated in French Polynesia. Overall, the pearl industry is shaped by both natural processes and human intervention through farming techniques.

-

The best natural pearls in the world

The Persian Gulf, particularly around Bahrain, has a rich history of producing some of the world"s finest natural pearls, known for their luster and unique colors. South Sea pearls from Australia, Indonesia, and the Philippines are also highly valued for their size and creamy hues. The Gulf of Mannar between India and Sri Lanka is recognized for its high-quality pearls with warm tones. Historically, the Persian Gulf"s pearl industry thrived until the early 1930s when oil discoveries shifted focus to more profitable ventures. This led to overfishing and pollution that devastated the pearl industry. Today, pearl oyster beds remain in the Persian Gulf, especially near Bahrain, where fishing has occurred for over two millennia. Despite other countries like Japan and Australia producing notable pearls, the Persian Gulf"s natural pearls are still considered among the best due to their unique environmental conditions. However, the legacy of traditional pearl diving has been largely overshadowed by industrial changes in the region. "

-

The difference between natural pearls and artificial and cultured pearls

Natural pearls form organically within mollusks without human intervention, resulting from irritants like sand. They are rare and valued for their unique characteristics. Cultured pearls, on the other hand, are created through human intervention by implanting a nucleus into the mollusk, leading to nacre secretion. While they closely resemble natural pearls in appearance and are more affordable, distinguishing between the two can be challenging. Specific weight is one method of differentiation, with natural pearls typically weighing less than 2. 73. Cultured pearls exhibit luminescence under UV light, while artificial pearls are man-made from materials like glass or plastic and lack the organic qualities of natural or cultured varieties. The rise of artificial pearl production in China has significantly impacted the natural pearl industry in regions like the Persian Gulf. Understanding these differences is crucial for consumers and traders in the pearl market.

-

How is the price of pearls determined?

The price of pearls is influenced by several key factors including type, size, shape, luster, color, surface quality, and origin. Natural pearls and rare varieties like conch or Tahitian pearls are more valuable due to their scarcity. Larger pearls are generally more expensive, with significant price increases for larger sizes. Round pearls are the most sought after for their symmetry, while other shapes like baroque are less valuable. Luster plays a crucial role; pearls with high luster reflect light better and command higher prices. Freshwater pearls are typically less expensive than Akoya or Tahitian varieties. The South Sea pearl is the most expensive type, with prices ranging from $1,000 to over $100,000 based on size and quality. The origin of the pearl also affects its value; those from renowned regions like the Persian Gulf or South Sea are often priced higher due to their reputation.

Market demand and trends can further influence prices as consumer preferences shift. Overall, the value of a pearl is determined by a combination of these factors.

-

What is a natural pearl?

Natural pearls are gemstones formed within mollusks, such as oysters and mussels, when an irritant becomes trapped in their soft tissue. The mollusk secretes layers of nacre around the irritant, resulting in a pearl over several years. Factors like the species of mollusk and environmental conditions influence the pearl"s shape, luster, and color. Historically valued for their beauty, pearls have been traded for thousands of years, particularly in regions like China. They can vary in color from white to blackish gray and come in various shapes, with round pearls being the most sought after. The size of pearls typically ranges from 7 to 9. 5 mm, with larger and smoother specimens commanding higher prices. While natural pearls are rare and highly valued in jewelry, most pearls on the market today are cultured, created through human intervention to initiate pearl formation.

Cultured pearls resemble natural ones but are more affordable and widely available. "