Uganda`s economy is primarily based on agriculture, which employs a significant portion of the population, though the country has been making strides in industrialization and service sectors. Coffee remains Uganda`s top export, followed by other agricultural products like tea, fish, and cotton. In recent years, the country has been exploring oil reserves in the Albertine Graben, which has the potential to significantly change its economic landscape. Uganda is a member of several regional trade organizations, including the East African Community (EAC) and the Common Market for Eastern and Southern Africa (COMESA), which enhances its trade with neighboring countries.

The financial and banking system in Uganda is regulated by the Bank of Uganda, the central bank responsible for monetary policy and financial regulation. The country`s banking sector is relatively liberalized, with several commercial banks, both local and international, operating within the country. Uganda`s currency is the Ugandan shilling (UGX), and while the economy has been relatively stable, inflation and exchange rate volatility can pose challenges for international trade. The country has been working on improving financial inclusion through mobile banking services, which have been transformative, especially for rural areas where access to traditional banking services is limited.

In terms of trade with the Middle East and West Asia, Uganda has been increasing its exports of agricultural products to these regions, particularly coffee, fruits, and vegetables. The United Arab Emirates (UAE) is a major trading partner in the Middle East, serving as a hub for re-exports. Uganda also imports petroleum products, machinery, and electronics from countries in the region. Additionally, there is growing interest in expanding trade ties with countries like Turkey and Saudi Arabia, especially in areas such as food security and agriculture. There has been some focus on attracting investment from Middle Eastern countries into Uganda`s infrastructure and energy sectors.

The trade relationship between Uganda and the Middle East is relatively nascent but shows promise. While Uganda`s exports to these regions are largely agricultural, there is potential for diversification, particularly in manufacturing and services. The government of Uganda has been working to improve the business environment through investment in infrastructure and the promotion of public-private partnerships. However, challenges remain, including logistical issues and the need for more robust trade agreements to facilitate smoother trade flows between Uganda and the Middle East and West Asia.

-

Nile Delta Minerals Ltd 10 months ago

Nile Delta Minerals Ltd 10 months ago Uganda

Director

Uganda

Director

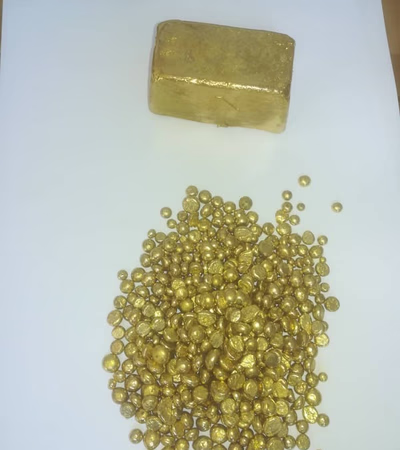

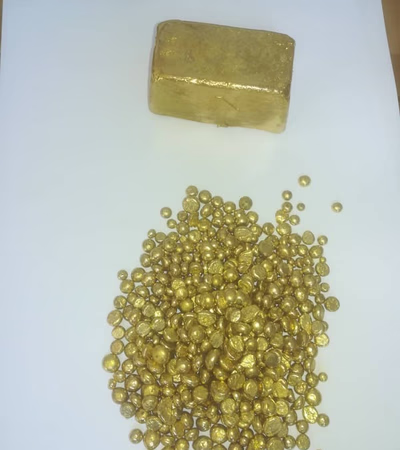

Gold(Au) purity is 97.6% price is 48000/kg Origin: Uganda and DR. CongoDetails

-

Pyamid Uganda Limited 3 months ago

Pyamid Uganda Limited 3 months ago Uganda

Minerals /Gold

Uganda

Minerals /Gold

We are a local mining community in uganda we deal specifically in Gold and other minerals like coltanDetails

-

Mohammed Jaber A Haris 3 months ago

Mohammed Jaber A Haris 3 months ago Uganda

Gold Bars and Diamond Seller

Uganda

Gold Bars and Diamond Seller

I am selling gold bars Karats 22 and Purity 97. 9%Details

In 2025, Uganda"s economic landscape presents a complex yet promising scenario for international business professionals. A significant insight is the country"s high reliance on agriculture, contributing over 24% to GDP in 2023, which is more than twice the global average of around 11%. This indicates potential for growth in agribusiness and related industries, especially as the world looks for sustainable food solutions. However, Uganda"s exports of goods and services as a percentage of GDP have seen a decline from 15. 8% in 2021 to just 11. 6% in 2023, notably lagging behind the global average of over 32%. This gap suggests room for improvement and opportunity for businesses to explore untapped export markets, particularly in Western Asia. Uganda"s GDP growth trajectory, increasing from approximately $40.

5 billion in 2021 to nearly $48. 8 billion by 2023, reflects a robust economic expansion. Despite this, the services sector"s contribution to GDP remains below the global average, highlighting another potential area for investment and development, particularly in sectors like tourism, information technology, and financial services. The industry sector, accounting for about 25. 8% of GDP in 2023, is also slightly below the global benchmark, pointing to opportunities in construction and manufacturing. On the trade front, Uganda"s merchandise import value index surged to 125. 0 in 2023 from 110. 1 in 2021, indicating increasing demand for foreign goods.

In contrast, the export value index showed a dramatic increase to 163. 4 in 2023, suggesting a potential recovery and expansion in international trade. Businesses can capitalize on this trend by enhancing the competitiveness of Ugandan products. For those considering market entry or expansion, platforms like Aritral. com offer vital tools such as AI-powered marketing and profile management services to elevate business visibility and facilitate direct communication with verified exporters and importers. Creating a business profile on Aritral. com could be a strategic move to leverage these emerging trade opportunities in Uganda and beyond.