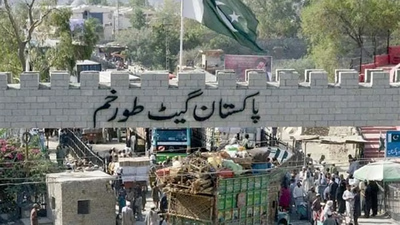

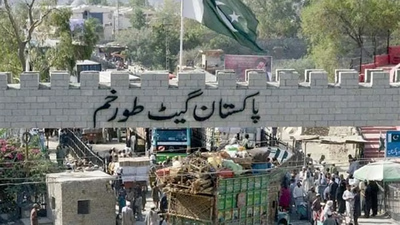

Pakistan Customs Authority ensures compliance in trade operations.

The Pakistan Customs Authority is responsible for enforcing customs laws and regulations in the country. It operates under the Federal Board of Revenue (FBR), which is a part of the Ministry of Finance. Customs duties are levied on imported goods entering Pakistan. The rates of duties vary depending on the nature of the goods, their classification, and any applicable trade agreements or exemptions. Additionally, other taxes such as sales tax, income tax, and federal excise duty may also apply to imported goods. Importers and exporters are required to comply with specific procedures for the clearance of goods. This includes filing relevant documentation, such as the Import General Manifest (IGM) or Export General Manifest (EGM), providing accurate information about the goods, and paying any applicable customs duties and taxes.

The decline peaked in 2002, and the government set four tariff groups, including 5, 10, 20, and 25 percent, for various goods. This rate is even lower than the WTO tariffs, and the average tariff is now close to 2.15 percent, a significant reduction from 1994 (56 percent). The tariff is 25% for most consumer goods, 10% for intermediate goods, and 5% for raw materials, and no goods are subject to customs for export from Pakistan. Restrictions on exports and imports in Pakistan are as follows:

- The federal government is allowed to restrict or prohibit the entry and exit of goods or to impose new regulations on them, following laws passed and in exceptional circumstances.

- The federal government may, by printing a notice in an official journal or newspaper, subject to certain conditions and restrictions, which it deems necessary, on each of the imported or exported goods, as set out in the tariff tables, to a maximum of the value decided. To impose duties to regulate that product.

- No goods are allowed to be exported or imported without a license issued by the official authorities and following legal procedures.

Pakistan Customs has measures in place to protect intellectual property rights. They collaborate with rights holders to enforce trademarks, copyrights, and patents, seizing counterfeit goods and infringing products at ports and borders. Pakistan has implemented various measures to facilitate trade and streamline customs procedures. This includes the adoption of electronic customs systems, such as the Pakistan Customs' Web-Based One Customs (WeBOC) system, to automate processes, reduce paperwork, and enhance efficiency. There are no restrictions on exports to Pakistan and only exporters must register with the Pakistan Export Promotion Office and obtain an export registration number.

The customs value of imported goods is determined based on the transaction value (the price actually paid or payable for the goods), adjusted as per customs valuation methods prescribed by the World Trade Organization (WTO) and Pakistan Customs laws. Pakistan customs laws prohibit the import or export of certain goods for reasons such as national security, public health, or environmental concerns. Additionally, specific goods may be subject to restrictions, requiring permits or licenses for import or export. Customs declarations are required for both import and export shipments. Goods may be subject to inspection by customs authorities to verify the accuracy of information provided, determine the customs value, and ensure compliance with regulations.

-

The Pakistan Customs Authority, under the Federal Board of Revenue, enforces customs laws and regulations, imposing duties on imported goods based on their classification and applicable trade agreements. Importers and exporters must adhere to specific clearance procedures, including filing documentation like the Import General Manifest (IGM) or Export General Manifest (EGM) and paying relevant taxes. Tariff rates have significantly decreased since 1994, with current rates set at 25% for consumer goods, 10% for intermediate goods, and 5% for raw materials. The government retains the authority to restrict or prohibit certain imports and exports under exceptional circumstances. Additionally, measures are in place to protect intellectual property rights by collaborating with rights holders to combat counterfeit goods. The adoption of electronic systems like WeBOC has streamlined customs processes, enhancing efficiency. While there are no restrictions on exports to Pakistan, exporters must register with the Pakistan Export Promotion Office. Customs value is determined based on transaction value adjusted per WTO guidelines. Certain goods face import/export prohibitions due to national security or health concerns, necessitating permits for compliance.

-

The State Bank of Pakistan (SBP) oversees the country"s banking regulations, focusing on foreign exchange and capital movement. Authorized Dealers (ADs) facilitate money transfers, both domestically and internationally, through various banking channels like wire transfers and online banking. The SBP"s regulations aim to prevent money laundering while ensuring stability in the foreign exchange market. Since 1994, importers can withdraw foreign currency without prior authorization for payments through FEBC remittances. The central bank also manages currency conversion rates based on economic factors such as inflation and trade partner currencies. Pakistan"s tax system includes direct taxes collected by the central government, while local governments impose additional taxes. In 2017, Pakistan"s imports totaled $55. 6 billion, ranking it as the 47th largest exporter globally, with exports at $24.

8 billion. Capital movements are regulated by the SBP, requiring reporting and approvals for certain transactions. Investors must comply with these regulations when transferring funds for investment purposes. Banks enforce Know Your Customer (KYC) guidelines to combat financial crimes by verifying customer identities during significant transactions.

-

Pakistan"s transportation sector is crucial for its economic development, with a focus on enhancing trade through its ports and railways. The Karachi Port Trust (KPT) and Port Qasim are key players in handling cargo, with KPT managing 30. 8 million tons in 2006-07 and showing a rise in activity in the current fiscal year. Port Qasim, catering to 40% of national shipping needs, recorded a growth of 10% in cargo handling during the same period. Gwadar Port holds significant potential for regional trade, aiming to connect Pakistan with Central Asia and beyond, while also promoting local economic growth. The government emphasizes infrastructure investment to support sustainable economic growth and improve supply chain solutions across the region. Railways are highlighted as an efficient alternative for long-haul transport, contributing to both passenger and freight movement while being environmentally friendly. Overall, the transportation landscape in Pakistan is evolving to meet the demands of international trade and regional connectivity. "

-

Recent economic changes in Pakistan have led to significant growth, particularly in manufacturing and financial services. The country has improved its foreign exchange position and reduced foreign debt, aided by the International Monetary Fund and U. S. debt forgiveness. GDP growth rates have steadily increased, reaching approximately 8. 4% by mid-2005, with the service sector now contributing about 53% to GDP. Despite these advancements, challenges such as inflation and lower reserves persist. The Karachi Stock Exchange has seen peaks alongside other emerging markets, attracting substantial foreign investment across various industries including telecommunications, textiles, and aerospace.

Sialkot has emerged as a key industrial hub, generating billions in exports from sectors like sports equipment and auto parts. The potential for growth in aerospace capabilities could further enhance economic development, with ongoing research into missile technology linked to the space program. Overall, while Pakistan"s economy shows promise through diversification and investment opportunities, it must navigate existing economic pressures to sustain its upward trajectory. "

-

Pakistan, officially the Islamic Republic of Pakistan, is located in South Asia and shares borders with India, Afghanistan, Iran, and China. It has a diverse geography that includes mountains, fertile plains, and deserts. The country has a population of over 228 million people and is the second-largest Muslim nation globally. Its capital is Islamabad, while Karachi is its largest city. Pakistan"s economy is a mix of agriculture, industry, and services, with textiles and agriculture being significant export sectors. The nation has a rich cultural heritage influenced by various ethnic groups and is known for its traditional music, dance forms, and sports like cricket. Despite facing political and economic challenges since its independence in 1947, Pakistan has experienced periods of growth. The country also offers numerous tourist attractions ranging from historical sites to natural beauty. "