Israel"s gemstone market presents a fascinating anomaly amidst global trade dynamics. While the country"s overall ores and metals exports as a percentage of merchandise exports have slightly declined from 1. 62% in 2021 to 1. 41% in 2022, the gemstones segment remains buoyant. This resilience is underpinned by Israel"s strategic positioning as a global trade hub, particularly in polished diamonds and precious stones like emeralds and sapphires. Analyzing the economic indicators, Israel"s energy intensity has decreased from 2. 59 MJ/$2017 PPP GDP in 2020 to 2. 3 in 2022, indicating increased efficiency in production processes.

This trend supports the gemstone sector"s growth by reducing costs and enhancing competitiveness. Moreover, the external balance on goods and services shows a consistent surplus, rising from USD 16. 81 billion in 2020 to USD 15. 5 billion in 2022, reflecting a robust trade framework capable of supporting gemstone exports. However, the market is not without challenges. The manufacturing sector"s contribution to GDP has fluctuated, with a slight decline from 12. 16% in 2020 to 11. 48% in 2022.

This suggests an opportunity for diversification within the gemstones industry, particularly in high-value segments like charoite and chrysocolla, which have yet to be fully explored. To bridge these gaps and leverage Israel"s established trade networks, businesses should consider platforms like Aritral. com. As an AI-driven B2B platform, Aritral simplifies international trade in commodities and raw materials, including gemstones. By utilizing services such as Product Listing and AI-Powered Marketing, businesses can enhance their visibility and streamline communication with global partners, ensuring growth and sustainability in this competitive sector. "

-

Walaa 4 months ago

Walaa 4 months ago Israel

Meteorite Stone

Israel

Meteorite Stone

I own a brown stone with fingerprints, an external penetration crust. The external color of the stone differs from the internal color, tending towards...Details

-

Salama 4 months ago

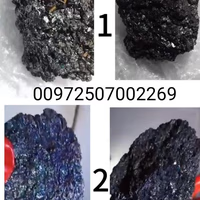

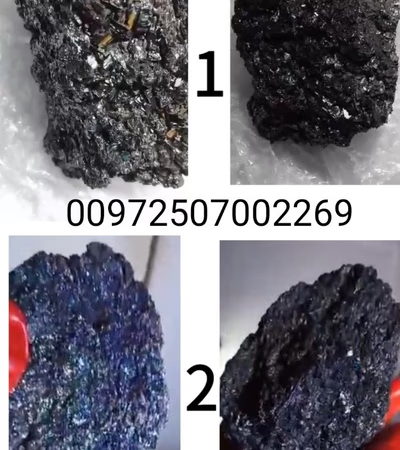

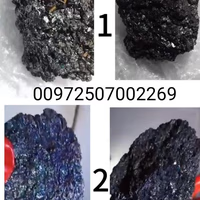

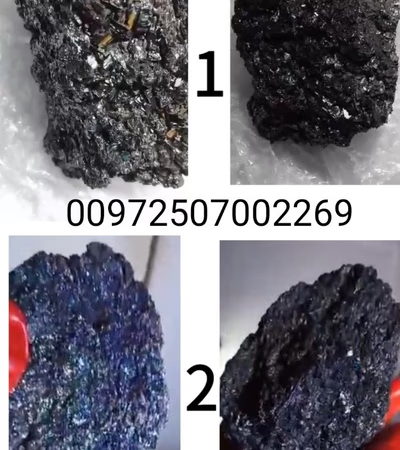

Salama 4 months ago Israel

Diamond meteorite stones black and blue

Israel

Diamond meteorite stones black and blue

I have two diamond meteorite stones for sale, one is black and the other is blue. They are located in Jordan. Those interested can contact me on Whats...Details

-

احجار كريمه 4 months ago

احجار كريمه 4 months ago Israel

Gems

Israel

Gems

Very small for examinationDetails

-

Abdullah Jaber 4 months ago

Abdullah Jaber 4 months ago Israel

Meteorites and Stones

Israel

Meteorites and Stones

Meteorite StoneDetails

-

Mansour Hamdan 4 months ago

Mansour Hamdan 4 months ago Israel

Agate Stones

Israel

Agate Stones

Orange and white agate stonesDetails

-

Youssef Sharawneh 4 months ago

Youssef Sharawneh 4 months ago Israel

Gemstones

Israel

Gemstones

I want to sell these stonesDetails

-

A&S For Accessories And Jewelry 4 months ago

A&S For Accessories And Jewelry 4 months ago Israel

Accessories, gemstones, pearls, and crafting

Israel

Accessories, gemstones, pearls, and crafting

The shop markets handmade accessories made of pearls and gemstones, as well as crafting silver and gold-filled itemsDetails